In the fast- moving world of decentralized finance, timing and structure matter. On Solana, two names constantly stand out when we talk about token launches, liquidity, and fair access Raydium Launchpad and Solana Meteora. We explore how these platforms work, what they bring, where they operate, and how accessible they really are for druggies and design brigades likewise. suppose of this companion as a chart — clear roads, visible signposts, and no gratuitous divergences.

Understanding the Solana Ecosystem

Why Solana Attracts Builders and Investors

Solana is frequently compared to a high- speed trace. Deals are presto, freights are low, and scalability is erected into the design. This makes it ideal for DeFi protocols that bear real- time prosecution and high outturn.

Part of DeFi structure on Solana

Without solid structure, speed means little. Launchpads and liquidity protocols form the backbone that allows systems to raise capital, distribute commemoratives, and maintain healthy requests.

What Is Raydium Launchpad?

Overview of Raydium Launchpad

Raydium Launchpad, also known as AcceleRaytor, is a token launch platform erected on Solana and integrated directly with Raydium’s robotic request maker( AMM). It allows new systems to launch commemoratives with instant liquidity.

Core Purpose and Use Cases

Raydium Launchpad focuses on

- Fair token distribution

- Immediate request access

- Strong liquidity from day one

This approach benefits both design brigades and early sympathizers.

How Raydium Launchpad Works

Token Launch Process

systems go through a vetting process. Once approved, commemoratives are offered to actors who stake RAY commemoratives to gain allocation rights.

Allocation and Participation

druggies stake RAY, admit league- grounded allocations, and share in launches transparently. No retired rules — just clear mechanics.

Benefits for Early Investors

- Early access to vetted systems

- Lower entry prices

- Reduced threat compared to arbitrary launches

Pricing and Costs on Raydium Launchpad

freights for systems

design brigades generally face

- Launchpad setup costs

- Liquidity provisioning conditions

- Marketing and compliance charges

Exact prices vary depending on compass and demand.

Costs for druggies

For druggies, costs are minimum

- Network freights( veritably low on Solana)

- occasion cost of staking RAY

Accessibility of Raydium Launchpad

Geographic Vacuity

Raydium Helipad is encyclopedically accessible wherever Solana is supported. No indigenous cinch- sways apply at protocol position.

Portmanteau and Platform Conditions

To share, druggies need

- A Solana-compatible portmanteau( like Phantom)

- shaft commemoratives

- introductory understanding of DeFi mechanics

Introducing Solana Meteora

What Is Solana Meteora?

Solana Meteora is a coming- generation liquidity protocol concentrated on dynamic liquidity operation. It optimizes capital effectiveness by conforming liquidity positions automatically.

Why Meteora Matters

Traditional liquidity pools frequently waste capital. Meteora changes that by conforming liquidity ranges in real time, keeping finances productive.

Crucial Features of Solana Meteora

Dynamic Liquidity Vaults

Liquidity shifts grounded on request conditions, analogous to an autopilot conforming altitude during flight.

Capital effectiveness

druggies can earn further with lower locked capital, making Meteora seductive for both small and large liquidity providers.

Pricing Structure of Solana Meteora

Liquidity Provider freights

freights are competitive and designed to award active participation. Providers earn from

- Trading freights

- Optimized yield strategies

Protocol Costs

There are no fixed subscription costs. freights are performance- grounded, aligning impulses across the system.

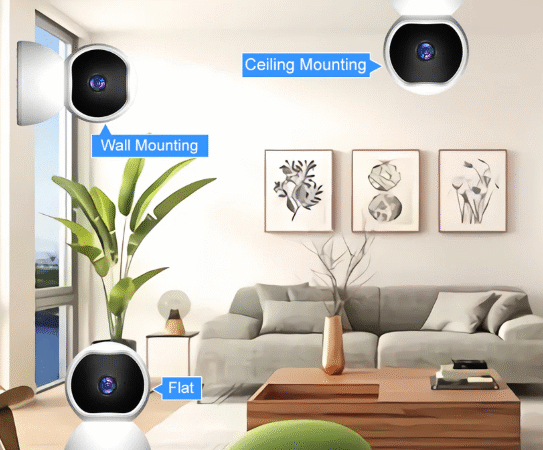

Availability and Usability of Meteora

Ease of Entry

Meteora is accessible through standard Solana holdalls

and DeFi dashboards. No complex setup is needed.

Target druggies

- Advanced DeFi druggies

- Liquidity providers

- systems seeking effective requests

Raydium Launchpad vs Solana Meteora

Different places, Same Ecosystem

While Raydium Launchpad focuses on token launches, Solana Meteora specializes in liquidity optimization. Together, they cover the full lifecycle of a commemorative.

reciprocal Strengths

A design can launch on Raydium Launchpad and latterly enhance liquidity using Meteora — like erecting a house and also installing smart energy systems.

Use Cases for systems

Startups and New Tokens

Raydium Launchpad offers visibility and trust.

Established Commemoratives

Meteora improves liquidity effectiveness and trading experience.

Security and translucency

checkups and Smart Contracts

Both platforms calculate on checked smart contracts and open- source principles, reducing systemic threat.

stoner Responsibility

As always in DeFi, druggies must manage holdalls

, keys, and threat precisely.

Future Outlook

Growth of Solana DeFi

With adding relinquishment, tools like Raydium Launchpad and Solana Meteora are likely to play central places.

Innovation Ahead

Anticipate further robotization, better UX, and deeper liquidity results.

Conclusion

Raydium Launchpad and Solana Meteora serve different but connected purposes within the Solana ecosystem. One helps systems enter the request fairly, while the other ensures liquidity works tidily, not harder. Together, they lower walls, reduce costs, and ameliorate availability for druggies worldwide. For anyone serious about Solana DeFi, understanding both platforms is no longer voluntary — it is essential.